Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Vietnam Surprised by Trump Tariff Decision, Seeks Lower Rate

Key Points

- Vietnam's leadership was surprised by US President Donald Trump's announcement of a 20% tariff, as they had anticipated a lower rate in the 10%-15% range.

- Following the announcement, Vietnam's party chief To Lam instructed negotiators to continue efforts to reduce the tariff rate.

- The Vietnamese government has limited public discussion of the tariff in state media, with instructions to avoid speculative content until a consensus is reached with the US.

- Vietnam is balancing relations with the US and China, its largest trading partner, while addressing US demands to prevent transshipment of Chinese goods through Vietnam.

- Despite the tariff uncertainty, foreign investors view the 20% rate as a favorable deal, with Vietnamese stocks reaching a three-year high.

Summary

Vietnam was taken aback by US President Donald Trump’s announcement of a 20% tariff on its exports, having expected a rate between 10% and 15%. Following a call with Trump, Vietnam’s party chief To Lam directed negotiators to push for a lower rate, as the higher figure was unexpected. The Vietnamese government has kept public discussion minimal, with state media instructed to avoid speculative content until an agreement is finalized with the US. Vietnam, a major export hub with a significant trade surplus with the US, is navigating complex relations with both Washington and Beijing, its largest trading partner. The US has pressed Vietnam to curb the rerouting of Chinese goods to evade higher tariffs, prompting Hanoi to tighten regulations on origin-of-goods fraud. Despite the uncertainty, foreign investors remain optimistic, with Vietnamese stocks hitting a three-year high, interpreting the tariff as a relatively good deal. Meanwhile, Vietnam continues to strengthen economic ties with China, including plans for a railway link, underscoring its delicate balancing act. Neither side has released detailed plans on how the 20% tariff or a 40% levy on transshipped goods will be enforced, leaving many questions unanswered as Trump considers broader tariffs of 15%-20% on other trading partners.

Josh Wingrove and Nguyen Dieu Tu Uyen

July 11, 2025

Stocks

Markets Embolden Trump on Tariffs, Stoking Fear of Overreach

Key Points

- Trump's Tariff Threats: President Trump has threatened to increase the universal tariff rate to 20%, doubling the current baseline, and proposed a flat tariff of 15-20% on all trading partners, surpassing the existing 10% rate.**

- Market Reactions: Financial markets showed mixed responses with declines in S&P 500 and European stock contracts, a slight rise in the dollar, and gains in export-dependent Asian equities despite the tariff news.**

- Market Complacency: Analysts and figures like Jamie Dimon of JPMorgan Chase warn that markets are too complacent about the risks of escalating trade frictions, with record highs and low volatility indices suggesting over-optimism.**

- Potential Economic Impact: Higher tariffs could lead to equity declines, weaker demand, and higher costs for imported goods, potentially impacting global economic growth, especially in regions like Southeast Asia.**

Summary

President Donald Trump has intensified trade tensions by threatening to raise the universal tariff rate to 20%, exceeding the current 10%, and proposing a 15-20% flat rate on all trading partners. This follows new levies on Canada and a steep 50% tariff on Brazil. Despite these threats, Trump cites record stock market highs as evidence of policy success, though financial markets displayed mixed reactions with declines in S&P 500 and European stocks, a stronger dollar, and gains in Asian equities. Analysts warn of market complacency, with figures like Jamie Dimon highlighting the risks of escalating trade frictions. Low volatility indices and record highs suggest markets may have priced in an overly optimistic outlook, ignoring potential economic fallout. Higher tariffs could trigger equity declines, weaker demand, and increased costs for imported goods, posing risks to global growth, particularly in export-heavy regions like Southeast Asia. While some fear an economic blow, inflation in the US remains contained, and the full impact of these tariffs—whether implemented or merely threats to gain concessions—remains uncertain. Market strategists advise caution, noting the policy overload and constant updates create a confusing environment for investors.

Katia Dmitrieva and Swati Pandey

July 11, 2025

Stocks

Trump tariffs live updates: Canada struck with 35% tariffs, Trump floats higher blanket rates

Key Points

- Trump's Tariff Agenda: President Trump is implementing significant tariffs, including a 35% tariff on Canadian goods starting August 1, citing fiscal retaliation and national security concerns like Fentanyl crossings and dairy duties.**

- Global Impact: Tariffs range from 15%-20% on most trading partners, 50% on Brazilian goods due to political issues, and 50% on copper imports, with a potential 200% tariff on pharmaceuticals looming.**

- Specific Country Deals: Vietnam faces a 20% tariff with a higher 40% on transshipped goods, while the EU is negotiating a 10% universal tariff with sector exemptions.**

- Market Reactions: Copper traders are shifting focus to Chinese buyers to offload metal before U.S. tariffs hit, while companies like Antofagasta see potential opportunities in stalled U.S. projects.**

- Political Fallout: Brazil's President Lula faces political and economic challenges with Trump's 50% tariffs, potentially using resistance as a strategy ahead of the 2026 election.**

Summary

President Trump is aggressively pursuing his tariff agenda, announcing a 35% tariff on Canadian imports starting August 1, citing issues like Fentanyl crossings and trade deficits, alongside broader tariffs of 15%-20% on most trading partners. Specific measures include a 50% tariff on Brazilian goods due to political grievances involving former President Bolsonaro, and a 50% tariff on copper imports, impacting global metal markets as traders pivot to Chinese buyers. Vietnam faces a 20% tariff, with higher rates for transshipped goods, while the EU negotiates a 10% rate with exemptions. These policies have sparked varied reactions, from economic uncertainty and potential retaliation from countries like China and Brazil to opportunities for companies like Antofagasta with stalled U.S. projects. In Brazil, President Lula grapples with political and economic fallout, potentially leveraging resistance to Trump’s tariffs for domestic support ahead of the 2026 election. The tariffs introduce significant uncertainty into global trade dynamics and domestic economies.

yahoo

July 11, 2025

Stocks

'It’s not political': Waller again calls for rate cut in July, reinforcing Fed divide

Key Points

- Federal Reserve Governor Christopher Waller supports cutting interest rates in July, arguing that inflation from tariffs is temporary and not politically motivated.

- Divisions within the Fed are evident, with some members like St. Louis Fed President Alberto Musalem remaining cautious about the duration of tariff-induced inflation.

- San Francisco Fed President Mary Daly anticipates two rate cuts this year, with September as a potential starting point, showing a slightly dovish stance.

- Waller’s influence is growing as a potential successor to Fed Chair Jerome Powell, whose term ends in May next year.

- President Trump aligns with Waller, urging rapid rate cuts to reflect economic strength and reduce interest on national debt.

Summary

Federal Reserve Governor Christopher Waller recently advocated for a potential interest rate cut in July, asserting that inflation from tariffs will be temporary and not politically driven. This stance highlights a growing divide within the Fed, as other members express varied opinions on the impact of President Trump’s tariffs on inflation and monetary policy. St. Louis Fed President Alberto Musalem remains undecided, cautioning that tariff effects on intermediate goods could have lasting inflationary impacts, while San Francisco Fed President Mary Daly leans toward two rate cuts this year, eyeing September as a possible start. Waller’s arguments gain significance as he is a potential candidate to replace Fed Chair Jerome Powell next May. Meanwhile, President Trump supports immediate rate cuts, citing economic strength and reduced debt interest costs. However, Fed Chair Powell and others advocate patience, pointing to a resilient economy and the need to assess tariff-driven inflation risks over the summer. Minutes from the June Fed meeting reveal further splits, with some members doubting any cuts this year due to persistent inflation risks, while others see tariff effects as temporary, supporting rate adjustments in 2023. This ongoing debate underscores the uncertainty surrounding inflation expectations and the Fed’s future policy direction amidst economic and political pressures.

yahoo

July 11, 2025

Stocks

Warren wants Trump’s FTC to see if companies are using tariffs as cover for price gouging

Key Points

- Renewed Call for Investigation: Senator Elizabeth Warren and 15 other Democratic lawmakers are urging the Federal Trade Commission (FTC) to investigate potential "tariff-enabled price-gouging" due to President Trump's trade policies, citing growing anecdotal evidence of price increases impacting consumers.**

- Evidence from Surveys: The Democrats reference a Federal Reserve Bank of New York survey indicating that some businesses are raising prices on goods unaffected by tariffs, possibly exploiting the current pricing environment, alongside passing on actual tariff costs.**

- Political and Economic Concerns: The letter highlights the political significance of consumer price effects from Trump's trade strategies, with Trump dismissing fears of price impacts and asserting that foreign entities should absorb tariff costs.**

- Previous Unanswered Request: This is the second letter from Warren and colleagues, following an unanswered May request, now pressing FTC Chair Andrew Ferguson to examine if large companies are using Trump's tariff policies to unjustly raise prices.**

- Mixed Research Findings: Additional surveys and expert opinions, including from Federal Reserve Governor Christopher Waller, suggest that while isolated price gouging may occur, it is not expected to significantly contribute to inflation beyond direct tariff effects.**

Summary

Senator Elizabeth Warren, alongside 15 Democratic lawmakers, has renewed a push for the Federal Trade Commission to investigate whether President Trump’s trade policies are leading to "tariff-enabled price-gouging." In a letter shared with Yahoo Finance, they cite anecdotal evidence from a Federal Reserve Bank of New York survey suggesting that some companies are raising prices on goods unaffected by tariffs, potentially exploiting the current economic climate, while also passing on actual tariff costs to consumers. This follows an unanswered May letter raising similar concerns. The Democrats emphasize the political weight of consumer price impacts, despite Trump’s assertions that foreign nations should bear tariff costs and his administration’s claims of declining imported goods prices. Surveys from the Institute for Supply Management and the New York Fed reveal mixed business responses, with some firms admitting to opportunistic price hikes. While Federal Reserve Governor Christopher Waller acknowledges isolated instances of gouging, he doubts it will significantly fuel inflation beyond direct tariff effects. Historical examples, like the 2019 tariff on washing machines inflating dryer prices, underscore unpredictable outcomes. With consumer effects from Trump’s trade plans under scrutiny, and Trump himself monitoring for price increases at companies like Walmart, the issue remains a focal point. The lawmakers, including prominent House and Senate Democrats, await a response from the Trump-appointed FTC Chair Andrew Ferguson, as the debate over tariffs and pricing continues to shape economic discourse.

yahoo

July 10, 2025

Stocks

Delta stock soars after earnings beat, reinstated guidance; CEO says tax bill and trade deals are removing uncertainty

Key Points

- Delta Air Lines (DAL) reported strong Q2 results with adjusted revenue of $15.5 billion, slightly below estimates, and EPS of $2.10, surpassing expectations.

- Delta reinstated its full-year EPS guidance of $5.25 to $6.25, reflecting improved economic clarity and confidence amidst global trade war challenges.

- The airline saw a stock surge of over 10%, triggering a sector-wide rally with gains in American Airlines (AAL), Southwest (LUV), and United Airlines (UAL).

- Premium revenue outperformed economy by 5%, and loyalty revenue grew 8%, driven by co-branded credit card spending with American Express.

- CEO Ed Bastian highlighted strong summer travel demand, especially internationally, and emphasized Delta’s focus on premium services as a competitive edge.

Summary

Delta Air Lines, the world’s largest carrier by revenue, reported robust second-quarter results, posting adjusted revenue of $15.5 billion and earnings per share of $2.10, beating expectations. Despite a slight revenue shortfall, the airline reinstated its full-year EPS guidance at $5.25 to $6.25, buoyed by improving economic conditions and progress in trade negotiations. Delta’s stock jumped over 10%, sparking a rally across the airline sector, with peers like American Airlines, Southwest, and United Airlines also seeing gains. CEO Ed Bastian noted stronger demand for the second half of the year, driven by consumer and business confidence, and highlighted Delta’s edge over budget carriers due to its focus on premium and business travelers. Premium revenue grew 5% faster than economy, while loyalty revenue rose 8%, fueled by partnerships like American Express. Bastian also praised a strong summer travel season, particularly internationally, despite trade war impacts on foreign passenger numbers. Delta’s investment in premium services and reliability positions it to capitalize on industry trends favoring quality experiences at competitive prices.

yahoo

July 10, 2025

Stocks

Trump’s 50% Levy on Brazil Shows World Nothing Is Off Limits

Key Points

- Trump's Tariff Threat: Donald Trump threatened a 50% tariff on Brazil, citing the treatment of former President Jair Bolsonaro and demanding the dismissal of charges against him, marking an unprecedented use of trade policy to influence foreign judicial proceedings.**

- Brazil's Response: Brazilian President Luiz Inacio Lula da Silva rejected Trump's interference, asserting national sovereignty and warning of economic reciprocity measures in response to any unilateral tariff hikes.**

- Broader Implications: This move raises concerns among US trade partners that any issue could become a trade agenda problem under Trump, undermining the reliability of formal trade agreements and reciprocal tariff negotiations.**

- Market Impact: The threat led to a 2.9% drop in the Brazilian real against the US dollar and a slight retreat in US equity futures, reflecting uncertainty over Trump's trade policies.**

- Global Trade Strategy: Trump's actions, including tariffs on other nations like Algeria and Libya, and threats to BRICS countries, indicate a broader strategy of using tariffs to achieve geopolitical goals beyond trade balances.**

Summary

Donald Trump has threatened a 50% tariff on Brazil over the judicial treatment of former President Jair Bolsonaro, marking a significant escalation in using trade policy for unrelated political demands. In a letter, Trump demanded the dismissal of charges against Bolsonaro, labeling the trial a "witch hunt." Brazilian President Luiz Inacio Lula da Silva firmly rejected this interference, emphasizing Brazil's sovereignty and warning of retaliatory economic measures. This unprecedented move has heightened concerns among US trade partners about the unpredictability of Trump's trade agenda, suggesting that any issue could trigger tariff actions, regardless of existing agreements. The threat caused a 2.9% drop in the Brazilian real and minor declines in US equity futures, reflecting market uncertainty. Trump's broader strategy includes tariffs on nations like Algeria, Libya, and BRICS countries, often tied to geopolitical goals such as curbing fentanyl flow or protecting the US dollar's dominance. Analysts warn that such actions could erode confidence in US trade policy stability, potentially pushing emerging economies closer together. Despite a negotiation deadline of August 1, 2025, skepticism remains about the finality of any deals, as Trump continues to wield tariffs as a tool for diverse objectives, leaving global trade relations in flux.

Swati Pandey and Katia Dmitrieva

July 10, 2025

Stocks

India Seeks to Dodge Trump’s BRICS Wrath as It Eyes Trade Deal

Key Points

- India's Stance on US Dollar: India is emphasizing that it has no intention of challenging the US dollar's global dominance, aiming to avoid conflict with President Donald Trump's criticism of BRICS.**

- Trump's Tariff Threats: Trump has labeled BRICS as "anti-American" and threatened tariffs, including a 50% levy on Brazil, while India faces potential 10% tariffs despite nearing a trade deal with the US.**

- India's Diplomatic Approach: Unlike other BRICS nations, India has refrained from public criticism of Trump's anti-BRICS remarks, focusing on maintaining strong ties with Washington.**

- Strategic Positioning: As India prepares for BRICS chairmanship in 2026, it seeks to differentiate itself from China and Russia by highlighting its neutral stance on currency issues and strategic value to the US.**

Summary

India is navigating a delicate balance in its relationship with the US amid President Donald Trump's criticism of the BRICS group, which he accuses of undermining the US dollar's dominance. While Trump has imposed significant tariffs on other BRICS nations like Brazil and threatened a 10% tariff on all members, including India, New Delhi is keen to avoid confrontation. Indian officials stress that the country does not support a unified BRICS currency or de-dollarization, focusing instead on reducing trade risks through local currency arrangements. Unlike Brazil and South Africa, India has refrained from publicly responding to Trump's remarks, prioritizing its strategic partnership with the US, especially as a counterweight to China. With a potential US-India trade deal on the horizon and India set to assume BRICS chairmanship in 2026, the country is positioning itself as distinct from other BRICS members like China and Russia. Despite recent strains, including Trump's claims regarding India-Pakistan relations, both nations aim to finalize the trade agreement by fall, which could reinforce their ties. India's cautious approach reflects its intent to maintain strong US relations while managing its role within BRICS.

Sudhi Ranjan Sen and Shruti Srivastava

July 10, 2025

Stocks

Trump promised 200 deals by now. He’s gotten 3, and 1 more is getting very close

Key Points

- Trade Deal Discrepancy: President Trump claimed to have completed trade deals with 200 countries within his first 100 days, but only three agreements—with China, the UK, and Vietnam—have been announced.**

- Deadline Extensions: Initially setting a deadline for trade deals, Trump postponed "Liberation Day" tariffs from July 9 to August 1 to allow more negotiation time, especially with the European Union.**

- EU Negotiations Progress: The US and EU are close to a framework agreement with 10% tariffs and ongoing discussions, marking a shift in Trump’s previously critical stance toward the EU.**

- Other Trade Challenges: Negotiations with countries like India, South Korea, and Japan face hurdles due to tariffs on key industries, with new tariffs imposed on Japan and South Korea at 25%.**

- Global Reactions: Some nations, including Indonesia, Cambodia, Thailand, and Brazil, are making substantial offers to secure deals, while the EU threatens countermeasures if no agreement is reached by the deadline.**

Summary

In his first 100 days, President Donald Trump claimed to have secured trade deals with 200 countries, yet only three—with China, the UK, and Vietnam—have been confirmed. Initially setting a deadline for global trade agreements, Trump delayed "Liberation Day" tariffs from July 9 to August 1 to allow more negotiation time, particularly with the European Union (EU). The EU and US are nearing a framework deal with 10% tariffs, a significant shift from Trump’s earlier criticism of the bloc, spurred by his threat of 50% tariffs. However, challenges persist with other nations like India, South Korea, and Japan, where sectoral tariffs on autos and steel remain contentious; Trump recently imposed 25% tariffs on Japan and South Korea. While countries such as Indonesia, Cambodia, Thailand, and Brazil are pushing for agreements, clarity on US expectations is lacking. Trump expresses frustration over unacceptable offers from trading partners, emphasizing his goal to stop countries from exploiting the US. The EU has warned of retaliatory measures if no deal is reached by the extended deadline, highlighting the high stakes of these ongoing negotiations.

yahoo

July 10, 2025

Stocks

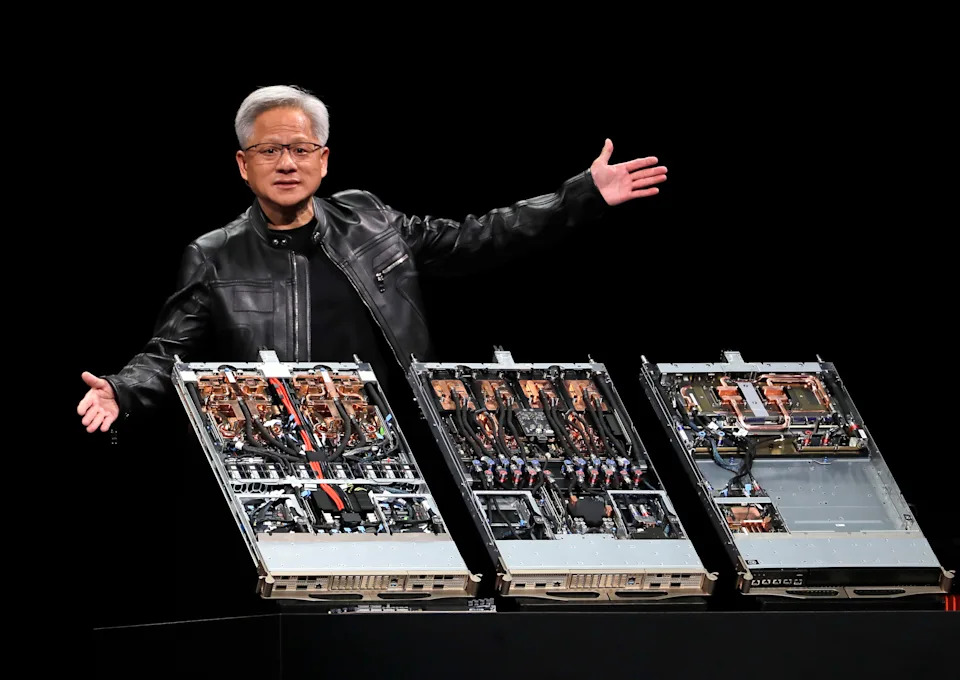

Nvidia becomes first $4 trillion publicly traded company

Key Points

- Nvidia (NVDA) became the first publicly traded company to reach a $4 trillion market cap, surpassing tech giants like Microsoft and Apple.

- The company's stock has risen 22% year-to-date and 24% over the past 12 months, driven by the generative AI boom.

- Nvidia's chips and software dominate AI training and inferencing, maintaining a competitive edge over rivals like AMD and Intel.

- Major tech firms, including Amazon, Google, and Meta, are investing heavily in Nvidia's hardware for AI data centers.

- Despite challenges like U.S. export bans to China and market fears, Nvidia's stock continues to climb with upcoming innovations like Blackwell Ultra chips.

Summary

Nvidia (NVDA) has achieved a historic milestone by becoming the first publicly traded company to reach a $4 trillion market cap, outpacing tech giants like Microsoft and Apple. The chipmaker's stock has surged 22% year-to-date and 24% over the past year, fueled by the generative AI boom that began with OpenAI's ChatGPT in 2022. Nvidia's specialized chips, graphics cards, and CUDA software platform are pivotal for training and running AI programs, giving it a significant edge over competitors like AMD and Intel. Major tech companies, including Amazon, Google, Meta, and Microsoft, are investing billions in Nvidia's hardware to build AI data centers. Despite setbacks, such as a $600 million market cap drop earlier this year and U.S. export bans to China costing billions, Nvidia's stock remains resilient. The company has debunked concerns about its chips' relevance in AI inferencing and continues to benefit from global demand, including sovereign AI initiatives in countries like Saudi Arabia and across Europe. With the upcoming release of its Blackwell Ultra chips and no major competitors in sight, Nvidia is poised for further growth in the AI-driven tech landscape.

yahoo

July 9, 2025

Stocks

Why Tesla is in trouble — aside from CEO Elon Musk's behavior

Key Points

- Tesla's Challenges: Tesla is facing a significant decline in demand, with 2024 deliveries dropping to 1.78 million vehicles from 1.8 million in 2023, marking its first year-over-year decline, alongside a 13.5% drop in Q2 deliveries and a 27.9% fall in European EV registrations in May.**

- Musk's Distractions: CEO Elon Musk's focus on politics and other ventures is seen as a distraction, with critics like Wedbush's Dan Ives urging the Tesla Board to set boundaries on Musk's political ambitions to refocus on the business.**

- Competitive Pressure: Tesla is grappling with intensifying competition from GM, Ford, Hyundai, and Volkswagen, compounded by an aging model lineup and brand fatigue, as noted by Cox Automotive's Stephanie Valdez Streaty.**

- Policy Impact: The loss of EV tax credits and regulatory credits under Trump's "One Big Beautiful Bill" poses a severe threat to Tesla's profitability, with significant revenue hits expected from reduced fines for CAFE standards and eliminated consumer incentives.**

- Future Bets: Tesla is pivoting towards AI and robotaxis, with ongoing tests in Austin, Texas, seen as a potential trillion-dollar opportunity, though execution and competition from Waymo and Amazon's Zoox remain challenges.**

Summary

Tesla is encountering significant hurdles as detailed in the article, with a notable decline in vehicle deliveries for 2024, dropping to 1.78 million from 1.8 million in 2023, marking its first annual decrease. This downturn is evident in a 13.5% drop in Q2 deliveries and a 27.9% fall in European EV registrations in May. Critics attribute part of Tesla's struggles to CEO Elon Musk's distractions with politics and other ventures, urging the board to refocus his efforts on the company. Meanwhile, Tesla faces fierce competition from GM, Ford, Hyundai, and Volkswagen, alongside brand fatigue and an aging product lineup. The loss of EV tax credits and regulatory credits due to Trump's "One Big Beautiful Bill" further threatens Tesla's bottom line, with significant revenue impacts expected. In response, Musk is steering Tesla towards AI and robotaxis, with tests underway in Austin, Texas, seen as a potential game-changer despite execution challenges and competition from Alphabet's Waymo and Amazon's Zoox. Analysts stress that Tesla must prioritize execution over innovation to navigate these turbulent times, balancing battery production, product updates, and regulatory scrutiny while addressing declining demand and policy shifts. Tesla's stock, down over 25%, reflects investor concerns, though optimism remains for autonomous technology to potentially redefine the company's future.

yahoo

July 9, 2025

Stocks

Who stands to benefit from the new SALT cap? High-earning homeowners in high-tax states.

Key Points

- SALT Cap Increase: The new tax bill raises the state and local tax (SALT) deduction cap from $10,000 to $40,000, benefiting homeowners in high-tax states like New York, New Jersey, and California by allowing more to itemize deductions and save thousands annually.**

- Impact on High Earners: High earners with expensive homes and large mortgages, particularly in high-tax areas, stand to gain the most from the increased SALT cap and unchanged mortgage interest deduction on the first $750,000 of a mortgage.**

- Temporary Measure: The higher SALT cap is temporary, effective from 2025 with a 1% annual increase, reverting to $10,000 in 2030, and households earning over $500,000 face a lower cap.**

- Broader Itemization: The change is expected to encourage more taxpayers to itemize deductions, reversing a trend since the 2017 Tax Cuts and Jobs Act, which pushed many toward the standard deduction.**

- Potential Market Effects: The SALT cap increase may drive demand and raise home prices in already tight, high-tax housing markets like San Jose and the New York metro area.**

Summary

President Trump’s new tax bill introduces significant changes for homeowners, particularly benefiting high earners in high-tax states. The state and local tax (SALT) deduction cap rises from $10,000 to $40,000, enabling more homeowners in states like New York, New Jersey, and California to itemize deductions and save thousands annually. This temporary measure, effective from 2025 to 2030 with a 1% yearly increase, also reinstates the mortgage insurance premium deduction and maintains the mortgage interest deduction on the first $750,000 of a mortgage. Financial experts note that working professionals with large mortgages will see the most benefit, while retirees with smaller or paid-off loans are less impacted. However, households earning over $500,000 face a reduced cap, and the policy may spur demand and price increases in already tight housing markets. Despite the relief, some wealthy Americans continue relocating from high-tax states due to cost of living and remote work trends. The bill reverses a post-2017 trend where only 10% of taxpayers itemized, potentially encouraging more to do so now.

yahoo

July 8, 2025

Stocks

'Some complacency has crept in': How FOMO and speculative bets are driving the 2025 market rally

Key Points

- Megacap and Speculative Surge: The stock market in 2025 is reaching new highs, driven by megacap stocks like Nvidia (NVDA) and Meta (META), alongside speculative trades in meme stocks like Palantir (PLTR) and heavily shorted stocks like Super Micro Computer (SMCI).**

- Retail Investor Influence: Retail traders are significantly impacting the market rally, with a focus on meme stocks, unprofitable tech, and riskier investments, as noted by Charles Schwab's Liz Ann Sonders.**

- Speculative Momentum Over Fundamentals: Investors are chasing high-beta momentum stocks and unprofitable companies, with data showing significant outperformance over traditional value stocks, raising concerns about market disconnect from fundamentals.**

- Wall Street Concerns: Experts like Chad Morganlander and Steve Sosnick warn of the gamification of markets and the dominance of momentum over fundamentals, signaling potential risks despite the ongoing rally.**

- Notable Performers: New market entrants like Circle (CRCL) and CoreWeave (CRWV) have seen massive gains, alongside Quantum Computing (QUBT), reflecting the speculative fervor in niche sectors.**

Summary

The stock market in 2025 is soaring to new heights, propelled by megacap giants like Nvidia and Meta, as well as speculative investments in meme stocks such as Palantir and heavily shorted names like Super Micro Computer. Retail investors are a driving force behind this rally, favoring riskier, unprofitable tech and momentum-driven trades over traditional fundamentals, as highlighted by experts like Liz Ann Sonders of Charles Schwab. Data from Goldman Sachs and Bespoke Investment Group shows unprofitable companies and high-beta stocks significantly outperforming the broader market, with nearly 420 Russell 3000 stocks surging over 50% in a short period. New entrants like Circle and CoreWeave have skyrocketed post-IPO, reflecting the speculative appetite. However, this disconnect from fundamentals raises red flags on Wall Street, with warnings of market gamification and potential risks from strategists like Chad Morganlander and Steve Sosnick. While momentum and fear of missing out (FOMO) currently dominate investor behavior, concerns linger that fundamentals will eventually reassert themselves, potentially leading to a market correction. For now, the bullish wave persists, though not without cautionary notes about future volatility.

yahoo

July 7, 2025

Stocks

Millions of workers are getting a raise as new minimum wage laws kick in

Key Points

- Minimum Wage Increases: Over 880,000 workers in Alaska, Oregon, and Washington, D.C., saw their minimum wage rise starting July 1, with D.C.'s rate increasing from $17.50 to $17.95 per hour.**

- Broader Impact: A dozen cities and counties, including Chicago, Los Angeles, and San Francisco, also raised their minimum wages, affecting nearly 3 million workers directly and over 6.2 million indirectly through pay structure adjustments.**

- Demographic Reach: Nearly 60% of workers benefiting from these increases are women, and almost half work full-time, as reported by the Economic Policy Institute (EPI).**

- Inflation and Affordability: These wage hikes aim to help workers cope with inflation, which peaked at 9.1% in mid-2022, though experts like Yannet Lathrop emphasize the need for further federal action beyond the stagnant $7.25 hourly rate.**

- State and Sector Variations: Increases vary by location and sector, such as California’s healthcare workers earning up to $24 per hour, and tipped employees in some areas also seeing adjusted minimum wages.**

Summary

Starting July 1, minimum wage increases have boosted pay for over 880,000 workers in Alaska, Oregon, and Washington, D.C., with D.C.'s rate rising from $17.50 to $17.95 per hour. Additionally, cities like Chicago, Los Angeles, and San Francisco, among others, have implemented wage hikes, impacting nearly 3 million minimum wage earners and over 6.2 million others indirectly through pay structure changes. According to the Economic Policy Institute, nearly 60% of affected workers are women, and almost half are full-time employees. These raises are crucial for combating inflation, which hit a 40-year high of 9.1% in 2022 before dropping to 2.4%, yet experts argue more federal action is needed as the national minimum wage remains at $7.25, unchanged for over 15 years. Variations exist by state and sector, with California’s healthcare workers seeing rates up to $24 per hour, and tipped employees in some regions also benefiting. Overall, 88 jurisdictions across 23 states are set to raise wages by the end of 2025, addressing an ongoing affordability crisis as highlighted by Yannet Lathrop of the National Employment Law Project. Legislative efforts like the Raise the Wage Act aim to push the federal minimum to at least $17 per hour over five years, reflecting a broader push for economic relief.

yahoo

July 6, 2025

Stocks

Trump tariffs live updates: Trump set to impose tariffs of up to 70% in letter push as July 9 deadline looms

Key Points

- Deadline Approaching: President Trump's July 9 deadline for imposing higher "reciprocal" tariffs on US trade partners is nearing, with tariff notifications starting to be sent out on Friday and new rates effective from August 1.**

- Tariff Variations: Tariff rates will vary widely, ranging from 10% to 70%, with around 100 trade partners expected to face at least a 10% rate, as stated by Treasury Secretary Scott Bessent.**

- Trade Deals Progress: Only a few trade agreements have been finalized, including a recent deal with Vietnam setting a 20% tariff on imports and a 40% rate on transshipped goods, while negotiations with other partners like Japan and the EU continue.**

- Specific Country Updates: The US has eased export restrictions with China on chip design software and ethane, while talks with Canada resume after scrapping a digital services tax, and Japan faces potential tariffs of 30-35%.**

Summary

As President Trump's July 9 deadline for imposing higher tariffs on US trade partners approaches, notifications of new rates—ranging from 10% to 70%—will be sent starting Friday, effective August 1. Treasury Secretary Scott Bessent anticipates around 100 partners will face at least a 10% rate, with a flurry of deals expected before the deadline. So far, only a few agreements have been secured, including a recent deal with Vietnam setting a 20% tariff on imports and 40% on transshipped goods. Negotiations with China show signs of easing tensions with lifted export restrictions on chip software and ethane. Meanwhile, talks with Japan have soured, with potential tariffs up to 35%, and the EU is open to a 10% tariff with exemptions. Canada has resumed discussions after scrapping a digital services tax. Trump's tariff strategy aims to bolster Treasury funds amid concerns over national debt, following a $3.4 trillion tax cut and spending package. With the clock ticking, Commerce Secretary Howard Lutnick and others face pressure to finalize more pacts, as the global economy seeks clarity on Washington's trade policies.

yahoo

July 6, 2025

Stocks

Coming soon to your 401(k)? BlackRock's new private equity target date fund

Key Points

- BlackRock's New Fund: BlackRock is launching a target-date fund including private equity and private credit, aiming to boost 401(k) returns by 0.5% annually, potentially increasing savings by 15% over 40 years.**

- Increased Risk Concerns: Experts highlight that these private market investments carry higher risks, fees, and lower liquidity compared to traditional index funds, posing challenges during market downturns.**

- Social Security Transparency Issues: The Social Security Administration has reduced public access to performance data, removing key statistics from its website and discouraging in-person visits, which impacts seniors without internet access.**

- Retirement Literacy Gap: Many Americans lack basic knowledge about Social Security and retirement planning, with nearly half guessing their savings needs and over 60% admitting insufficient investment understanding.**

- Investment Anxiety: Nearly half of Americans are hesitant to invest due to market volatility and retirement savings concerns, with experts advising diversified, long-term strategies to manage risk.**

Summary

This article by Kerry Hannon on Yahoo Finance covers several personal finance and retirement issues. BlackRock is introducing a target-date fund for 401(k)s that includes private equity and credit, promising higher returns but with increased risks, fees, and liquidity concerns. Meanwhile, the Social Security Administration has limited transparency by removing performance data from its website, urging online interactions despite accessibility challenges for many seniors. The piece also highlights a widespread lack of retirement literacy, with many Americans guessing their savings needs and lacking investment knowledge. Additionally, nearly half of Americans are wary of investing due to market volatility, with experts recommending diversified, long-term strategies. Hannon emphasizes the need for better education and risk management as economic uncertainties persist, affecting retirement planning for everyday investors.

yahoo

July 5, 2025

Stocks